What if I have a transaction that belongs to more than one client? Instructions on how to assign those funds to different client matters.

What does it mean to “split transactions amongst multiple client matters?

When you “split up” a transaction you are breaking up the funds within - thus allowing you to allocate the funds amongst multiple client matters.

How do I split a transaction?

From your Nota [Trust] dashboard, identify the transaction you’d like to split up under “Untagged Transactions”.

Step 1: On the right side of the transaction line, you will see two arrows pointing in opposite directions. ![]()

Step 2: When you click the two arrows, you will see an “Allocate to multiple matters” button appear.

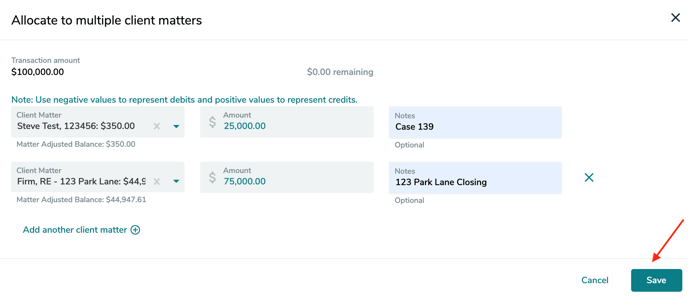

Step 4: A new window will appear prompting you to enter the client name, dollar amount, and any applicable notes to the funds you’re splitting and allocating.

Step 5: Click “Save” after completing the required fields.

What happens after I split up a transaction and allocate it to multiple client matters?

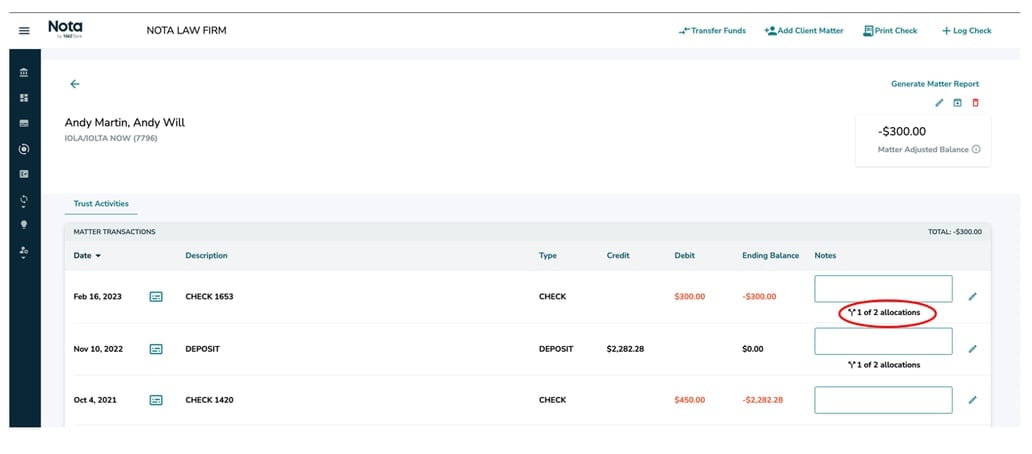

Transaction details will be housed inside of the designated client matter.

You’ll see a note indicating the transaction as one that was allocated as part of a split.

It is possible to assign a negative dollar amount to a client matter while tagging or splitting a transaction.

Need help?

If you have any questions or would like assistance, please contact Nota Customer Success at 1-800-724-1313 or email support@trustnota.com.

Banking services powered by M&T Bank, Member FDIC.

References to “IOLTA” or “Interest on Lawyers Trust Account” shall be interpreted to include “IOLA,” or “Interest on Lawyer Account,” and “IOTA,” or “Interest on Trust Account,” as applicable in a particular state.

Nota is a product/service offered by M&T Bank and is available to attorneys whose offices and practices are in NY, NJ, MD, PA, DE, CT, VA, DC, NH, MA, ME, VT, FL, or WV. IOLTA accounts held by lawyers in these states must be subject to applicable state rules and regulations. The advertised product/services and their features and availability are subject to change without notice at any time. Use of the product/service is subject to and governed by certain terms, conditions, and agreements required by M&T Bank.

© 2024 M&T Bank. All Rights Reserved.